Prepare to embark on an exhilarating voyage through the world of innovation and resilience as we unveil the captivating story of Garmin. In a realm where technology titans like Apple and Google cast colossal shadows, Garmin’s narrative shines with the brilliance of adaptability, triumph, and strategic ingenuity. Join us as we delve into the remarkable journey of Garmin, a journey marked by pioneering spirit, audacious pivots, and the creation of a premium brand in a competitive landscape. This is a tale of how a trailblazing company, established in 1989, transformed adversity into opportunity, surmounting every challenge and ultimately conquering the premium running wearables market.

The Garmin Phenomenon: How They Outsmarted Apple and Google

Must-Read! ⬇️

source: https://www.economist.com/business/2023/09/12/meet-the-plucky-firms-that-are-beating-big-tech

Let’s embark on a comprehensive exploration of Garmin’s extraordinary journey and gain insight into how they adeptly navigated the formidable challenges that came their way:

- Pioneering GPS Navigation: With its inception in 1989, Garmin emerged as an early leader in the realm of GPS navigation systems designed for commercial use. The company’s unwavering commitment to innovation and unwavering dedication to quality laid a robust foundation for their future ventures.

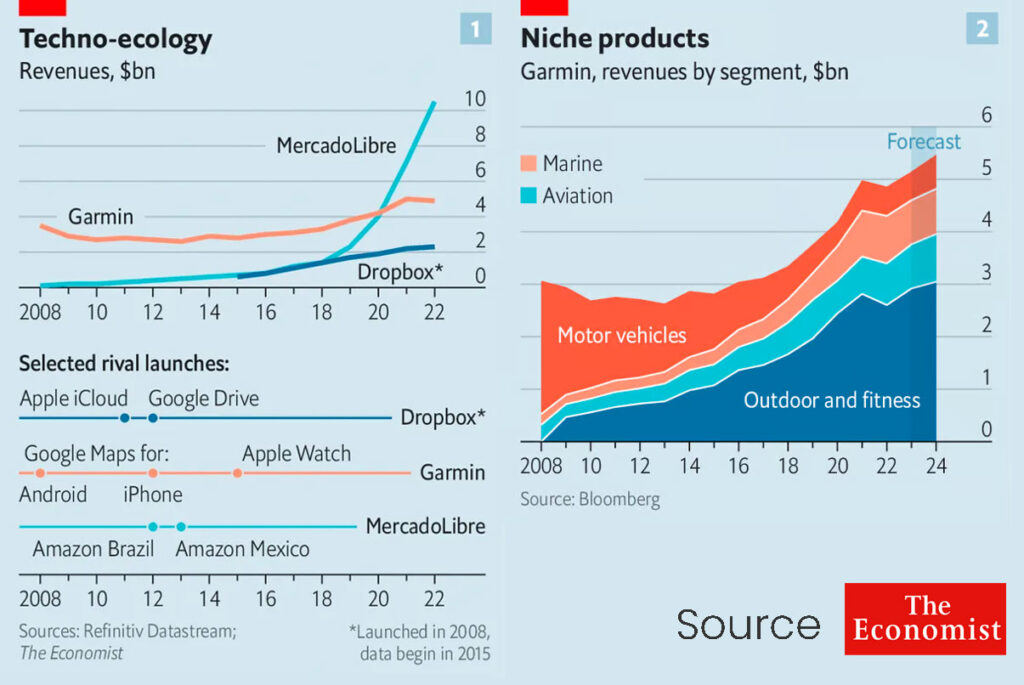

- Dominance in Portable Navigation: As we approached the year 2008, Garmin had not only carved out a prominent presence but had also secured a commanding position in the portable navigation device market. The majority of their revenue flowed from dashboard-mounted units tailored for automobiles, contributing a remarkable 72% to the company’s sales.

- Disruption from Google: Nonetheless, the technological landscape underwent a profound transformation with the introduction of Google’s revolutionary Google Maps app. Initially launched for Android smartphones in 2008 and subsequently made available for iPhones in 2012, this innovation empowered users to utilize their smartphones for navigation, significantly reducing their reliance on dedicated GPS devices.

- Challenges from Apple: In the ensuing years, Garmin confronted a fresh challenge when Apple made a foray into the market with its inaugural smartwatch. This development presented a formidable threat to Garmin’s thriving business, which was predominantly centered on crafting specialized devices tailored for fitness enthusiasts and outdoor adventurers.

- Strategic Pivot: Remarkably, Garmin responded to this challenge with remarkable resilience and adaptability. They executed a strategic pivot, shifting their focus towards the creation of high-end watches and fitness trackers. Some of these products bore price tags considerably higher than those of the top-tier Apple Watch.

- Loyal User Base: The audacious shift in strategy paid off handsomely as Garmin succeeded in nurturing a dedicated and unwavering user base comprised of mountaineers, runners, and fitness enthusiasts. Their products resonated deeply with individuals seeking specialized features, durability, and uncompromising quality.

- Creating a Premium Brand: Notably, Garmin’s exceptional journey included the creation of a premium brand, as highlighted by George Livadas of Upslope Capital, an investment firm. In a market where a formidable Apple alternative thrived, Garmin succeeded in distinguishing itself by consistently delivering superior quality and niche features that resonated with specific user groups.

- Impressive Revenue Growth: Today, Garmin’s total annual revenues are on the verge of breaching the $5 billion mark, nearly doubling their levels from the time the first Apple Watch was introduced to the market.

- Diversified Portfolio: The cornerstone of Garmin’s current business resides in smartwatches and fitness trackers, accounting for nearly 60% of the firm’s sales. Remarkably, they have thrived in segments beyond wearables, including professional navigation systems meticulously tailored for the intricate worlds of ships and aircraft (see chart 2). This diversification underscores Garmin’s adaptability and unwavering resilience.

Who can easily get inspiration from Garmin?

As we delve deep into Garmin’s remarkable journey, there’s a valuable lesson to be learned for players in the wearable market. Particularly, Amazfit by Zepp Health could draw inspiration from Garmin’s strategic evolution since they are doing good in mid-range premium smartwatch for athletes, runners & lifestyle users. Amazfit, known for its range of wearables, should consider shifting its focus towards high-end and premium offerings while gradually phasing out its emphasis on low-ticket products. They have good range of series, and should partner with sports organizations and influencers. Amazfit can partner with sports organizations and influencers to promote its products to their target audience. For example, Amazfit could partner with a running organization to sponsor a marathon or a cycling organization to sponsor a bike race.

Assessment of India’s Wearable Ecosystem: The Indian wearable market holds a substantial share of over 34% in the global market, mainly due to the availability of products at lower average selling prices. Applause is in order for Indian brands like Noise and Fire-Boltt, both of which have achieved impressive year-on-year growth rates of 86% and 70%, respectively. As discussed in a previous post addressing the Hidden Challenges in Shaping the Future of the Wearable Smart Watch Industry in India, upcoming challenges are anticipated in areas such as customer support, post-sales service, and the quality of hardware, particularly within the context of the low average selling price (ASP) range. These challenges can be tackled through strategic investments in manufacturing, the incorporation of premium sensors, heightened research and development efforts, and the importation of advanced technology. Noise and Fire-Boltt are already making strides in this direction, although resolving these issues completely will take some time. The growth of the Indian wearable category is propelled by widespread awareness campaigns, including a substantial marketing budget (averaging 11%), celebrity brand endorsements, a focus on fashion and lifestyle, and a swift product release cycle.

Garmin’s success story serves as a prime example of the rewards that come from such a strategic pivot. They harnessed the loyalty of a discerning user base by catering to specialized needs with top-tier products. Currently, in the Indian wearable ecosystem, there is a limited degree of loyalty, except when it comes to brands like Apple with their devoted following or Garmin specializes in high-end smartwatches and fitness trackers, which appeal to a loyal user base of mountaineers, runners, and other fitness enthusiasts.

Garmin is a relatively niche player in the global smartwatch market, but it is by far the biggest producer of athletic watches. Its direct competitors include a pair of Finnish companies – Polar, which was the first to offer real-time heart rate monitoring in wearable devices, and Suunto – and US-based Coros. Coros is a relative newcomer in the athletics wearables market having been founded in 2016, but which has already developed a strong reputation that it bolsters by including multiple world champions among a roster of sponsored athletes. Apple has been eyeing the athletic watch market and its recent launch of the Watch Ultra signals its first attempt to muscle in on the scene. Garmin has positioned itself in the high-end smartwatch and fitness tracker market by focusing on product innovation, durability, features, and brand reputation. The company has a strong customer base of fitness enthusiasts and outdoor adventurers who value its durable and accurate products. Garmin is well-positioned to continue to grow its market share in this segment in the coming years.

In a competitive landscape, where the wearable market continues to evolve, Garmin’s journey serves as a beacon of adaptability and resilience, proving that a calculated shift in strategy can lead to not just survival, but thriving in the face of formidable rivals like Apple and Google.

Leave a Reply