The Indian wearable industry has been witnessing significant growth, and several key trends are emerging in the market. One of the most prominent trends is the transition of the hearables market to true wireless stereo (TWS) technology, which now accounts for over 45% of the overall market. The TWS segment is expected to grow by over 70% in the next 2-3 years, driven by customer preferences for smart audio, adaptive active noise cancellation (ANC), spatial sound, and other lifestyle elements.

Also check, The State of the Wearable Industry in India: A Closer Look @ 2022 Business Analysis

Another key trend in the Indian wearable industry is the growth of gaming TWS, which has grown by 250% YoY, targeting the ever-growing gaming audience in India. Additionally, the round AMOLED BT calling segment is poised to be the next major growth driver for H1’23, with its share further expected to grow to 60%+ by H1’23.

| Categories | Key Points |

| Market Segments | – TWS segment poised to grow 70%+ over 2-3 years – Round AMOLED BT Calling to be next major growth driver for H1’23 – Preference of smaller dial size to cater to growing search volumes for women: 175% growth from Jan-Oct 2022 – Personal audio sales expected to reach 70M units in 2021, 80M units in 2022, 100M units in 2023, and 120M units in 2024 – Wearable category to sell 12M units in 2021, 30M units in 2022, 40M units in 2023, and 55M units in 2024 |

| Customer Preferences | – Smart Audio, Adaptive ANC, Spatial Sound & other lifestyle elements are key customer preferences – Gaming TWS has grown by 250% YoY with wider customer acceptance, targeting the ever-growing gaming audience of India – Customer preference moving from branded to unbranded with search share increased to 65% from 51% |

| Technological Innovations | – New Technological innovation in LTE Enabled Watches, Kids & OS driven Category |

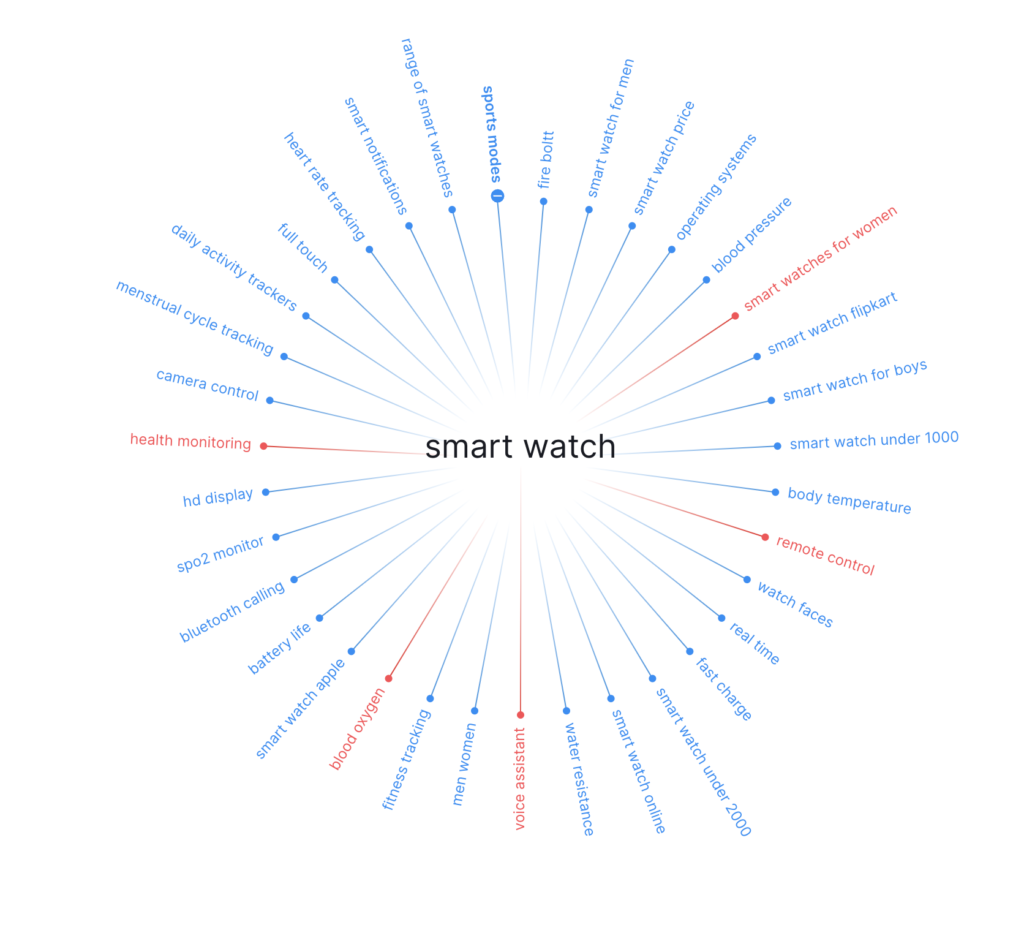

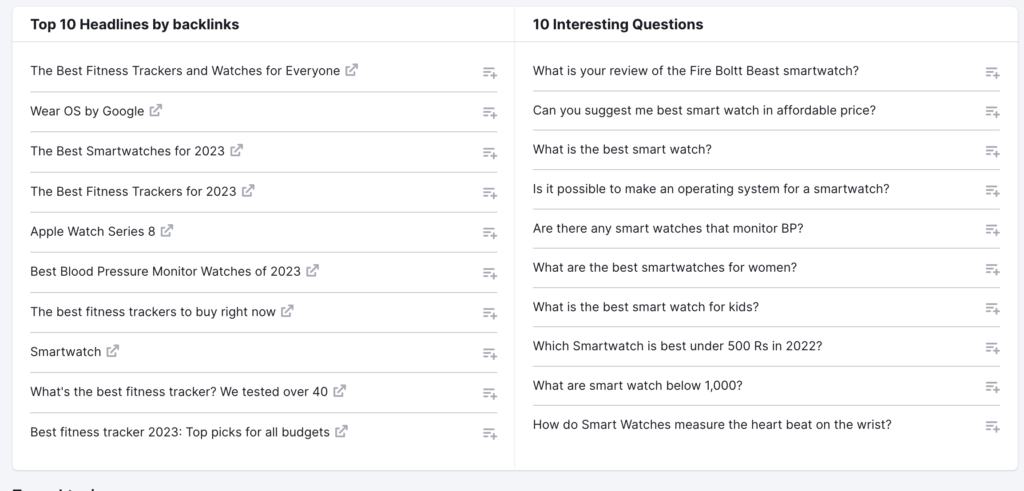

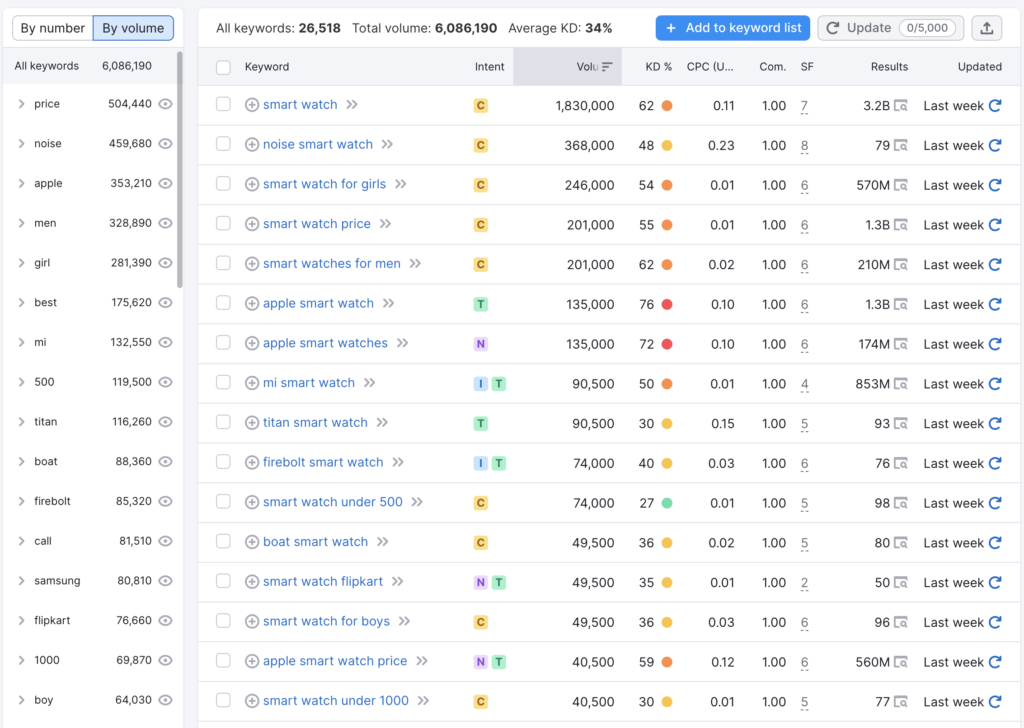

Customer Relative Searches on Google around Smart Watch

Customer preferences are also evolving in the Indian wearable industry. There is a growing preference for smaller dial size to cater to the increasing search volumes for women, with a 175% growth from January to October. Furthermore, customers are moving towards unbranded products, with search share increasing from 51% to 65%.

The Indian wearable industry is also witnessing new technological innovations, such as LTE-enabled watches, kids’ wearables, and OS-driven categories. In terms of sales, the personal audio category has been the largest with 70 million units sold in 2021. This category is expected to grow to 80 million units in 2022, 100 million units in 2023, and 120 million units in 2024. The wearable category, on the other hand, is expected to sell 12 million units in 2021, 30 million units in 2022, 40 million units in 2023, and 55 million units in 2024.

Overall, the Indian wearable industry is poised for significant growth, with a focus on technological innovation, customer preferences, and evolving market trends.

Leave a Reply